Economic sanctions have become one of the most widely used tools of international diplomacy since the end of World War II. In recent decades, their use has accelerated sharply, particularly after the Cold War, as countries increasingly rely on sanctions to pursue geopolitical and security objectives. While sanctions are intended to influence political behaviour, they also carry substantial economic consequences—especially for emerging markets and developing economies (EMDEs) that depend heavily on foreign capital.

A central question for policymakers and investors alike is whether sanctions discourage foreign direct investment (FDI), and if so, how strong and persistent that effect is. In my recent study, Do sanctions deter Greenfield FDI inflows? An empirical investigation, with Sasidaran Gopalan and Kathia Bahloul Zekkari, we provide one of the most comprehensive answers to date by focusing specifically on Greenfield FDI, the form of investment most closely linked to long-term growth, job creation, and capital formation.

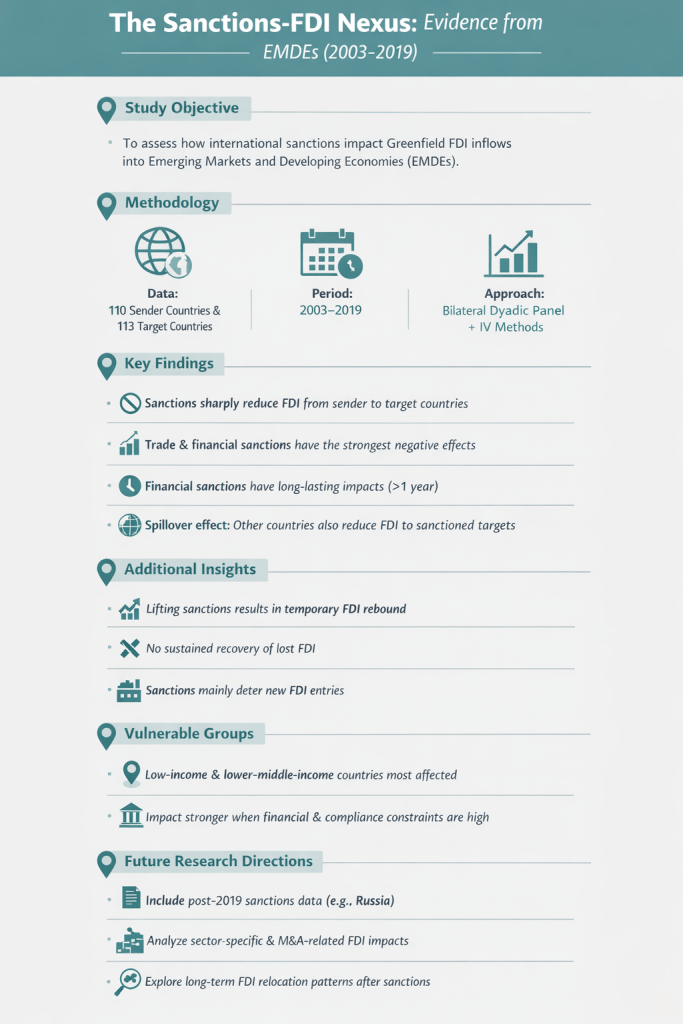

To give a quick, visual overview of the study’s objective, data, approach, and main findings, the infographic below summarizes the paper in one page.

Why Focus on Greenfield FDI?

Not all foreign investment is the same. Aggregate FDI statistics typically combine Greenfield investments—where firms build new facilities or expand existing ones—with mergers and acquisitions (M&A). However, a large body of research shows that the economic benefits traditionally associated with FDI—such as technology transfer, employment generation, and productivity gains—are driven primarily by Greenfield projects rather than M&A transactions.

Greenfield investments involve high upfront costs, long planning horizons, and sunk capital. These features make them especially sensitive to uncertainty, financing constraints, and political risk. As a result, they are particularly vulnerable to policy shocks such as sanctions. Despite this, most earlier studies on sanctions and FDI have examined only aggregate flows. This paper fills an important gap by analysing how sanctions affect Greenfield FDI specifically.

A Global, Dyadic Perspective on Sanctions and Investment

In this study, we assemble a rich bilateral (dyadic) dataset covering 110 sanctioning (sender) countries and 113 target countries over the period 2003–2019. Greenfield FDI data are drawn from the fDi Markets database, while sanctions data come from the Global Sanctions Database. This allows us to examine not just whether a country is sanctioned, but which country sanctions whom, and how that bilateral relationship affects investment flows.

The study distinguishes between different types of sanctions, including:

- Economic sanctions (trade and financial sanctions), and

- Non-economic sanctions (arms, military, and travel sanctions).

This distinction is crucial, because different sanctions constrain multinational firms in different ways—by limiting market access, raising the cost of capital, disrupting financing channels, or increasing reputational and compliance risks.

Sanctions Significantly Reduce Greenfield FDI

The paper’s core finding is clear: sanctions significantly reduce Greenfield FDI inflows from the sanctioning country to the target country. On average, bilateral Greenfield FDI flows are about 53 percent lower when sanctions are in place compared to non-sanctioned country pairs.

However, the magnitude of the effect varies substantially by sanction type. Economic sanctions have the strongest impact. Trade sanctions and financial sanctions reduce Greenfield FDI by roughly 50 percent, reflecting their direct effects on profitability, financing, and operational feasibility. In contrast, non-economic sanctions—such as arms or travel restrictions—have smaller and sometimes statistically insignificant effects.

This pattern aligns with the paper’s conceptual framework. Because Greenfield investments require long-term financing and predictable cash flows, measures that raise transaction costs, restrict access to capital, or disrupt global value chains are especially damaging to investment decisions.

Are the Effects Temporary or Persistent?

Another important contribution of the study is its analysis of timing. We investigate whether the decline in Greenfield FDI is merely a short-lived response or whether it persists over time.

We find that the effects of sanctions are not purely transitory. Financial sanctions, in particular, continue to depress Greenfield FDI one year after their imposition, reflecting prolonged disruptions to banking relationships, insurance, and cross-border payments. Military sanctions, by contrast, show a delayed effect, with Greenfield FDI falling more sharply in the second year—possibly due to worsening security conditions and rising operational risks.

Interestingly, the study finds little evidence of systematic declines in Greenfield FDI before sanctions are formally imposed. This suggests that the observed investment losses are driven mainly by the sanctions themselves rather than by pre-existing downward trends.

Sanctions Also Deter Third-Country Investors

One of the most striking findings of the paper concerns spillover effects. Sanctions not only reduce investment from the sanctioning country; they also discourage Greenfield FDI from third countries that are not directly involved in the sanctioning relationship.

The study shows that all major types of sanctions lead to significant reductions in Greenfield FDI from other countries into the sanctioned target. This “cooling effect” reflects the reality of modern global finance: even firms based in non-sanctioning countries often rely on international banks, insurers, and suppliers that are subject to sanctioning jurisdictions. Compliance risks, secondary sanctions, and supply-chain disruptions increase uncertainty for all investors, not just those from sender countries.

These spillover effects persist over time and are strongest for financial sanctions, highlighting their central role in shaping global investment decisions.

Unilateral vs. Multilateral Sanctions

The paper also distinguishes between unilateral and multilateral sanctions. While unilateral sanctions—especially financial ones—already have sizable negative effects on Greenfield FDI, multilateral sanctions are even more damaging. When multiple countries coordinate sanctions, compliance becomes stricter, enforcement more credible, and alternative financing channels harder to access. As a result, Greenfield investment declines are larger and more widespread.

The study further shows that when sanctions are imposed as packages—combining several types at once—the negative impact on Greenfield FDI deepens significantly. This finding underscores how layered and coordinated sanctions can amplify economic consequences beyond what any single measure would achieve.

Policy Implications

The findings carry important implications for both policymakers and host countries. For sanctioning governments, the results highlight that sanctions—especially financial sanctions—can have powerful and persistent economic effects that extend beyond their immediate political targets. For EMDEs, the results underscore the vulnerability of long-term investment to geopolitical shocks and the importance of maintaining stable financial and institutional environments.

More broadly, the study challenges the notion that investment simply diverts smoothly from sanctioned countries to alternative investors. Instead, sanctions often generate widespread caution among multinational firms, reducing new investment even from countries not directly involved in the dispute.

Concluding Thoughts

By focusing on Greenfield FDI and using a large bilateral dataset, this paper provides some of the clearest evidence to date that sanctions significantly deter the type of foreign investment most closely associated with long-term economic development. Economic sanctions—particularly financial sanctions—emerge as the most potent constraint on new investment, with effects that are persistent and globally contagious.

For researchers, policymakers, and investors seeking to understand the real economic footprint of sanctions, this study offers a rigorous and timely contribution grounded in empirical evidence.

To cite this article: Khalid, U., Gopalan, S., & Zekkari, K. B. (2026). Do sanctions deter Greenfield FDI inflows? An empirical investigation. Economic Modelling, 155, 107421.

Link to this article: https://doi.org/https://doi.org/10.1016/j.econmod.2025.107421